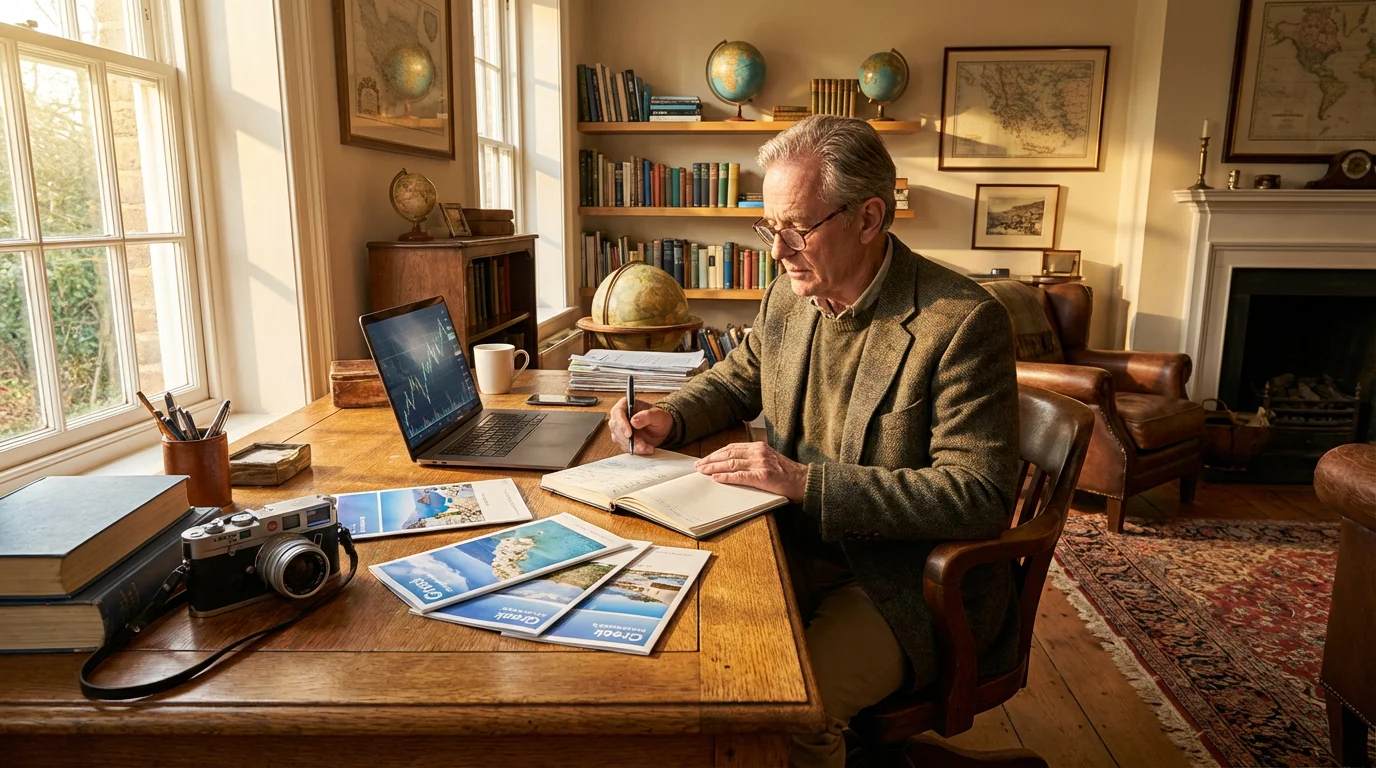

Retirement marks a significant life transition, presenting an opportunity to redefine your daily existence. Many envision this chapter as a time of relaxation, but an active retirement lifestyle offers so much more. You gain the freedom to pursue passions, contribute meaningfully, and explore new horizons. This guide empowers you to plan a retirement filled with purpose, engagement, and adventure, moving beyond traditional notions of winding down.

Redefining Retirement: Beyond the Daily Grind

Retirement is not an endpoint, it is a vibrant new beginning. For many pre-retirees and new retirees, the prospect of an active retirement offers profound benefits. You replace the structured demands of a career with the liberating pursuit of personal interests, social connections, and community involvement. This shift profoundly impacts your mental, physical, and emotional well-being.

Engaging in meaningful activities keeps your mind sharp, your body moving, and your spirit uplifted. Data consistently shows that individuals who maintain an active social and physical life in retirement experience higher levels of satisfaction and overall health. Think of this as your chance to cultivate a life that truly reflects your values and aspirations, free from previous professional constraints. What truly energizes you?

Discovering Your Passions: Hobbies for an Active Retirement

An active retirement lifestyle thrives on curiosity and engagement. Hobbies provide structure, social interaction, and mental stimulation. Whether you rekindle old interests or discover entirely new ones, the world of senior hobbies is vast and welcoming. Consider activities that challenge you, connect you with others, or simply bring you joy.

Many retirees find that exploring 55+ communities can make these activities more accessible through dedicated on-site facilities and social clubs.

Many retirees find immense satisfaction in pursuits they previously lacked time for. This could involve exploring artistic talents, delving into intellectual studies, or engaging in physical activities that promote longevity. Your hobbies can become a central pillar of your active retirement, filling your days with purpose and pleasure.

Popular retirement hobbies you might explore:

- Creative Arts: Painting, sculpting, pottery, writing, photography, music lessons, learning an instrument. These activities foster self-expression and can connect you with local art communities.

- Physical Activities: Walking groups, hiking, cycling, swimming, yoga, Pilates, gardening, golf, pickleball. Regular physical activity maintains health, boosts mood, and provides social opportunities.

- Intellectual Pursuits: Book clubs, lifelong learning courses at local universities or community centers, learning a new language, genealogy research, strategy games like chess or bridge. These keep your mind agile and engaged.

- Practical Skills: Woodworking, cooking classes, home brewing, DIY projects, computer coding, digital photography editing. Developing new skills offers a sense of accomplishment and practical benefits.

- Nature and Outdoors: Bird watching, fishing, camping, volunteer conservation efforts, nature photography. Connecting with nature reduces stress and promotes physical activity.

Starting a new hobby often involves taking a class or joining a local group. Many community centers, senior centers, and even online platforms offer introductory courses, making it easy for you to try something new without a significant upfront commitment.

The best time to plant a tree was 20 years ago. The second best time is now.

The Power of Giving Back: Volunteering in Retirement

Volunteering offers a powerful pathway to an active and fulfilling retirement. It provides purpose, social connection, and the satisfaction of contributing to your community. As a retiree, you possess a lifetime of experience, skills, and wisdom that can make a profound difference. Studies show that volunteering improves mental health, reduces isolation, and can even extend longevity.

Think about causes you care deeply about or skills you want to utilize. Many organizations eagerly welcome retired professionals, seeking their expertise in areas from finance to marketing, or simply their time and dedication. This is an opportunity to leave a lasting legacy while enriching your own life.

Avenues for volunteering in your community:

- Community Support: Assisting at food banks, soup kitchens, libraries, or local senior centers. These roles often involve direct interaction and provide immediate help to those in need.

- Mentorship Programs: Guiding younger professionals, students, or entrepreneurs. Your career experience provides invaluable insights for the next generation.

- Environmental Causes: Participating in park cleanups, trail maintenance, or conservation efforts. These activities combine physical activity with a commitment to preserving natural spaces.

- Health and Wellness: Volunteering at hospitals, hospices, or local health clinics. You can provide companionship, administrative support, or assist with various programs.

- Animal Welfare: Working with animal shelters, fostering pets, or assisting with animal rescue organizations. If you love animals, this offers a deeply rewarding experience.

- Arts and Culture: Docent at a museum, usher at a theater, or supporting local arts organizations. Combine your love for culture with community engagement.

Begin by researching local non-profits, community organizations, and religious institutions in your area. Many platforms, such as AARP’s volunteer matching service, can connect you with opportunities aligned with your interests and availability. Consider what skills you want to share and what kind of impact you want to make.

Exploring the World: Travel Opportunities for Retirees

Travel represents a quintessential element of an active retirement for many. With more flexible schedules, you gain the freedom to explore destinations near and far, creating unforgettable memories and enriching your perspective. Whether you dream of international adventures, cross-country road trips, or serene getaways, planning your travel vision is an exciting part of retirement.

Travel offers unique benefits, including cultural immersion, physical activity, and the joy of shared experiences with loved ones. It challenges you to adapt to new environments, broadens your understanding of the world, and provides incredible stories for years to come. Consider how travel fits into your overall retirement lifestyle and budget.

Tips for planning your retirement travel:

- Define Your Travel Style: Do you prefer organized tours, independent exploration, cruising, or RV travel? Your preferred style dictates planning and budgeting.

- Prioritize Destinations: Create a bucket list of places you want to visit. Research specific attractions, cultural events, and the best times to travel to these locations.

- Budget Realistically: Factor in transportation, accommodation, food, activities, insurance, and emergency funds. Explore off-season travel or senior discounts for cost savings.

- Consider Health and Accessibility: Assess your physical capabilities and choose destinations and activities that align with your health needs. Research accessibility options for lodging, transportation, and attractions.

- Travel Insurance: Investigate comprehensive travel insurance policies, especially for international trips or cruises. This protects you against unforeseen medical emergencies or trip cancellations.

- Flexibility is Key: While planning is essential, be open to adapting your itinerary. Unforeseen opportunities or changes in circumstances can lead to new, exciting experiences.

Many retirees discover joy in extended stays, renting homes in new cities for several weeks or months. This allows for deeper immersion in local culture and a more relaxed pace of travel. Before embarking on any major travel plans, review your health coverage, especially if traveling internationally. Medicare.gov provides resources to understand your options regarding health coverage outside the U.S.

Integrating Passions into Your Retirement Budget

An active retirement lifestyle requires thoughtful financial planning. Your hobbies, volunteering efforts, and travel aspirations all come with associated costs. Integrating these passions into your retirement budget ensures you can pursue them sustainably without financial stress. This proactive approach helps you allocate resources effectively, ensuring your desired lifestyle is achievable.

Along with activity costs, ensure your long-term finances are secure by reviewing estate planning essentials to handle your future legacy.

Evaluating downsizing decisions is also a practical way to free up more of your monthly income for travel and adventure.

Your financial plan should reflect your lifestyle goals. For example, if extensive travel is a priority, you need to budget accordingly for flights, accommodations, and activities. Conversely, if you plan to dedicate more time to local hobbies and volunteering, your budget might focus on supplies, classes, or local transportation.

Steps to align your passions with your budget:

- Assess Current Expenses: Understand your current spending patterns. Identify areas where you can reallocate funds towards your active lifestyle goals.

- Estimate Activity Costs: Research the costs associated with your desired hobbies, volunteering commitments, and travel plans. Factor in equipment, lessons, membership fees, and transportation.

- Prioritize and Allocate: Decide which activities are most important to you. Allocate a specific portion of your monthly or annual retirement income towards these passions.

- Explore Discounts and Free Options: Many senior centers offer free or low-cost classes. Public libraries provide resources for learning. Senior discounts for travel, entertainment, and even some volunteer organizations can reduce expenses.

- Review and Adjust Regularly: Your interests and financial situation may evolve. Review your budget annually to ensure it still supports your desired active retirement lifestyle.

Working with a qualified financial advisor helps you construct a comprehensive retirement income plan that supports your lifestyle aspirations. They can help you project expenses, optimize your income sources, and ensure your savings last throughout retirement. You can find accredited professionals through resources like the CFP Board. A thorough financial review ensures your active retirement remains sustainable and enjoyable.

Health and Wellness: Supporting Your Active Lifestyle

Maintaining an active retirement lifestyle fundamentally relies on your health and wellness. Prioritizing physical and mental well-being allows you to fully engage in hobbies, volunteering, and travel. Proactive health management becomes a cornerstone of your retirement planning, enabling you to pursue your passions with vigor and enjoyment.

Maintaining independence while staying active often involves aging in place strategies that allow you to stay in your home safely for longer.

Your choices today directly impact your capacity to remain active in the future. Regular check-ups, a balanced diet, consistent exercise, and adequate sleep all contribute to your long-term vitality. Addressing health concerns early prevents them from limiting your desired lifestyle later.

Key aspects of health and wellness for an active retirement:

- Regular Physical Activity: Engage in a mix of cardiovascular, strength, and flexibility exercises. This improves mobility, energy levels, and reduces the risk of chronic diseases.

- Balanced Nutrition: Adopt a diet rich in fruits, vegetables, lean proteins, and whole grains. Proper nutrition fuels your body for all your activities.

- Mental Stimulation: Keep your brain active through hobbies, learning, and social interaction. This supports cognitive function and overall mental health.

- Social Connection: Maintain strong social ties through group activities, volunteering, and family interactions. Social engagement combats loneliness and supports emotional well-being.

- Preventative Care: Schedule regular medical check-ups, screenings, and vaccinations. Early detection and treatment of health issues are crucial for maintaining an active life. The National Institute on Aging provides valuable resources on healthy aging.

- Stress Management: Practice mindfulness, meditation, or other relaxation techniques. Managing stress contributes significantly to both mental and physical health.

Consider consulting with your doctor to develop a personalized wellness plan. Discussing your activity goals helps them provide tailored advice and ensure your health supports your aspirations. Remember, investing in your health is investing in your active retirement.

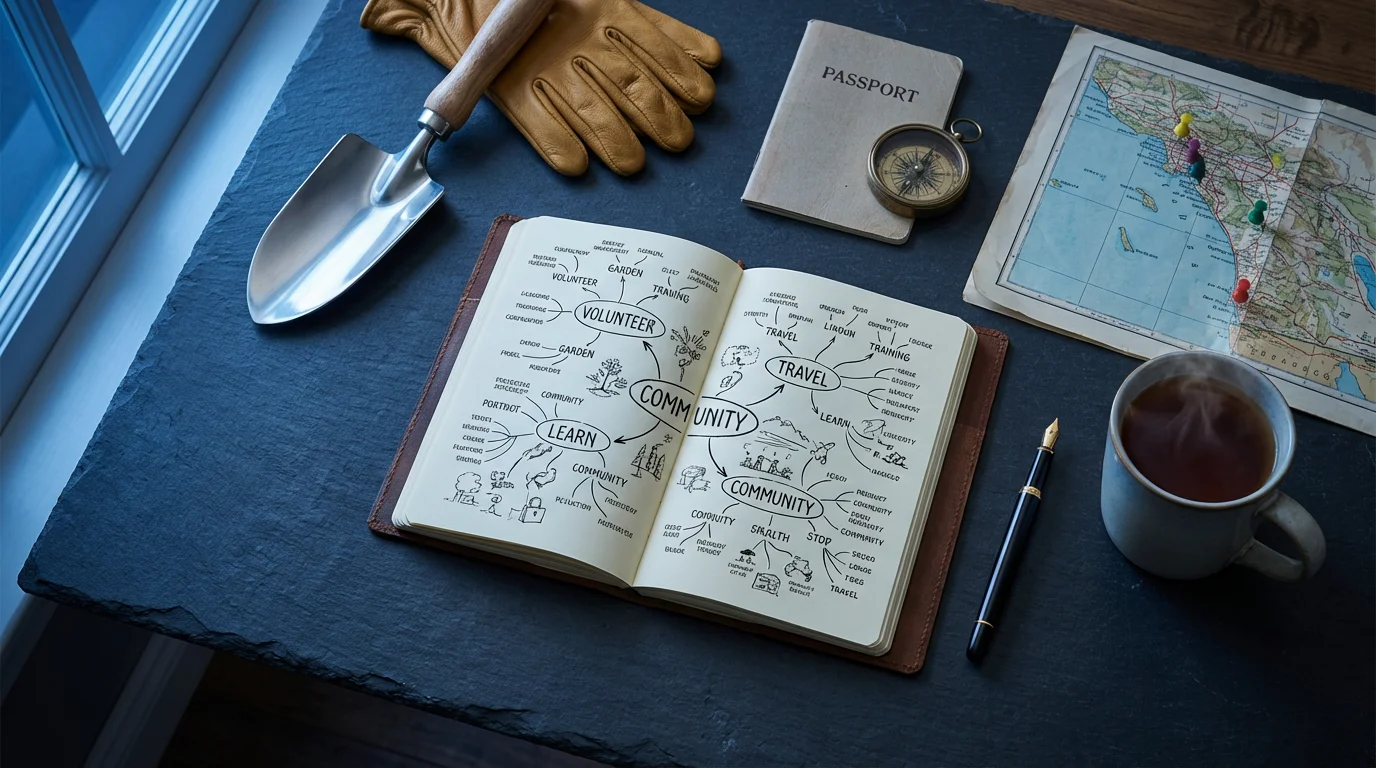

Building Your Active Retirement Blueprint: A Step-by-Step Approach

Creating an active retirement blueprint involves strategic planning, thoughtful consideration, and a willingness to adapt. This proactive approach ensures you transition smoothly into a life filled with purpose and passion. Start visualizing your ideal retirement years now, even if you are still some years away from leaving the workforce.

Your blueprint should also address where you want to live, perhaps by choosing the right retirement community that matches your desired lifestyle and activity levels.

Your blueprint should be a living document, evolving as your interests and circumstances change. Involve your spouse or partner in these discussions to ensure shared goals and expectations. Engaging in this planning process early provides a clear roadmap for your exciting next chapter.

Actionable steps for building your active retirement blueprint:

- Self-Reflection (5-10 years pre-retirement): Begin by reflecting on what truly brings you joy, what skills you want to develop, and what impact you wish to make. Consider past hobbies you enjoyed and new ones you want to try.

- Research and Exploration (3-5 years pre-retirement): Investigate potential hobbies, volunteering opportunities, and travel destinations. Talk to retirees already living an active lifestyle for insights and recommendations.

- Trial Runs (1-2 years pre-retirement): If possible, try out a new hobby, volunteer for a short-term project, or take a trial trip. This helps you gauge your interest and suitability before fully committing.

- Financial Assessment (Ongoing): Work with a financial advisor to ensure your desired lifestyle is financially sustainable. Adjust your savings and investment strategies to support your active retirement goals.

- Health Planning (Ongoing): Consult with your doctor to optimize your health. Create a wellness plan that supports your physical and mental capacity for activity and travel.

- Build Your Network (Ongoing): Cultivate relationships that support your active lifestyle. Join clubs, meet new people, and engage with communities that share your interests.

- Stay Flexible: Recognize that plans can, and often should, evolve. Embrace new opportunities and be prepared to adapt your blueprint as life unfolds.

Remember, the goal is to design a retirement that truly reflects who you are and what you value. By taking these steps, you lay a strong foundation for an active, engaging, and deeply satisfying retirement journey.

Frequently Asked Questions

What are popular retirement hobbies?

Popular retirement hobbies span a wide range, including creative arts like painting or writing, physical activities such as hiking or gardening, intellectual pursuits like learning a new language or joining a book club, and practical skills such as woodworking or cooking. The best hobbies are those that genuinely interest you and align with your physical capabilities.

How can I stay active in retirement if I have limited mobility?

Limited mobility does not prevent an active retirement. Focus on activities tailored to your capabilities, such as chair yoga, water aerobics, seated strength training, adaptive gardening, or intellectual pursuits like online courses, reading, and virtual volunteer roles. Consult with your doctor or a physical therapist to identify safe and effective activities.

How do I find volunteering opportunities in my community?

You can find volunteering opportunities by contacting local non-profit organizations, community centers, hospitals, libraries, and religious institutions directly. Online platforms like AARP’s volunteer resource center or VolunteerMatch also connect you with opportunities based on your interests and location.

What is the most important financial consideration for an active retirement?

The most important financial consideration for an active retirement is ensuring your retirement income and savings are sufficient to cover your desired lifestyle expenses, including hobbies, travel, and potential healthcare costs. A comprehensive budget and regular consultation with a financial advisor are essential to maintain financial security while pursuing your passions.

How far in advance should I start planning my active retirement lifestyle?

Begin planning your active retirement lifestyle at least 5-10 years before your target retirement date. This allows ample time for self-reflection, researching options, trying new activities, and adjusting your financial and health plans. Proactive planning ensures a smoother and more fulfilling transition into retirement.

Can I combine hobbies, volunteering, and travel?

Absolutely, combining these elements creates a rich and diverse active retirement. You might volunteer for a conservation project in a national park during a travel excursion, or join a local arts group in a city where you are spending an extended stay. Integrating these passions maximizes your engagement and enjoyment in retirement.

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, tax, or investment advice. Retirement planning decisions should be made in consultation with qualified professionals including certified financial planners, tax advisors, and estate planning attorneys. Individual circumstances vary significantly, and this content should not be relied upon as a substitute for professional advice tailored to your specific situation.

Leave a Reply